Holding payments

Reserve money from the client's card when paying and get paid when the service is provided

What is a payment hold?

This is payment for a product or service with prior authorization. At the first stage, the money on the client's card is not debited, but reserved for a certain period. During this time, the seller must confirm the transaction.

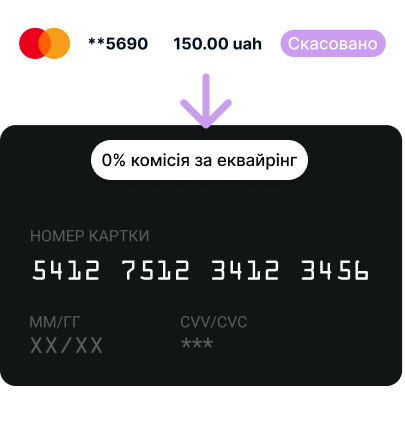

If the product is not available, the reserve is removed and the money remains on the buyer's account. Acquire takes the commission only for a successful payment.

Partial debiting is also possible when the seller can confirm only part of the order.

How does payment holding work?

The holding process consists of two stages

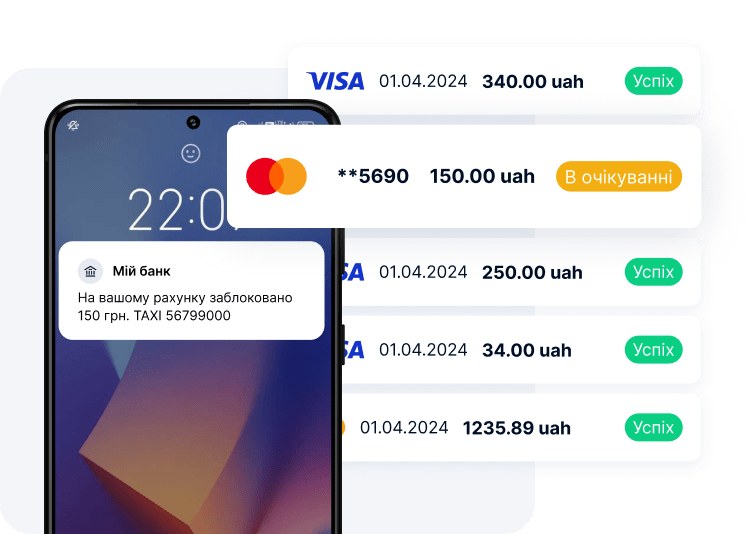

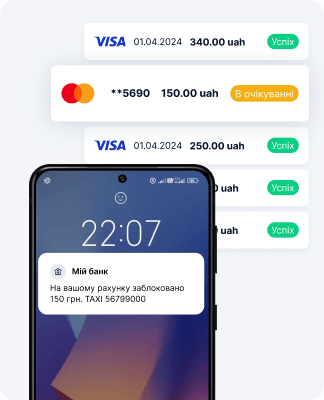

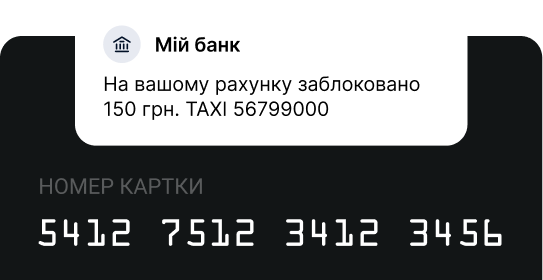

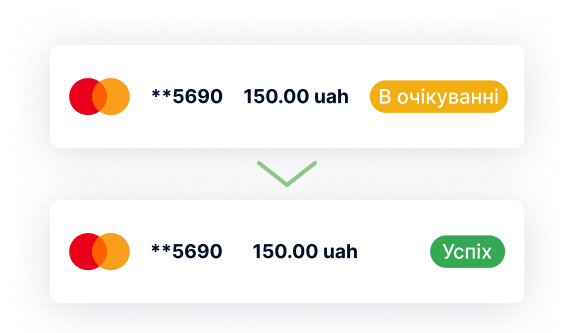

When the buyer confirms the payment, the corresponding amount is blocked on his card. The money remains in the client's account, but becomes unavailable for other payments.

The seller starts the actual debit, transferring funds from the client's card to his balance. The exact moment of write-off is determined by your own decision.

Advantages of holding payments

For example, online payment in a taxi. Initially, the funds are only blocked, and after the trip is completed, they are debited from the card.

The buyer can reserve the goods for himself until receipt, and the seller until confirmation of availability.

This service is convenient when booking hotels or renting a car. Business owners can take a security deposit with the possibility of quick repayment.

Free cancellation

If the transaction doesn't happen, the payment provider doesn't charge its fees, which saves the merchant money and makes two-step payment beneficial in many areas.

Who needs a payment hold?

Reserve the customer's prepayment before receiving the product or service

Withhold prepayment from the client until actual occupancy

While the courier is still on the way - withhold payment from the client and debit upon receipt

Reserve money while the taxi is still on the way